Key takeaways:

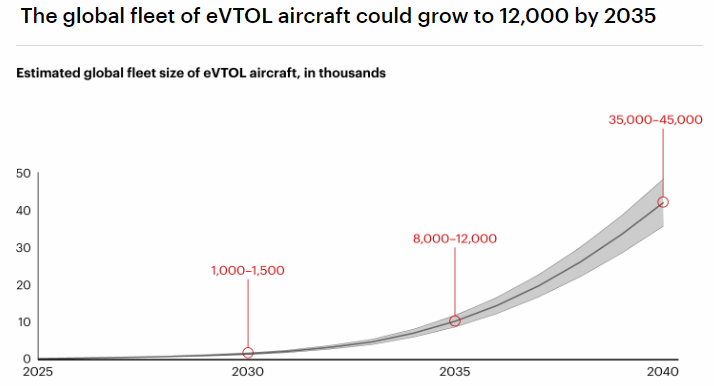

- Commercial air taxi services are expected to start in the next two to three years, with 12,000 operating globally by 2035, according to a report from consulting firm Bain & Co.

- Many factors must come together to make it work: build-out of landing sites, end-to-end route planning, lower prices, regulatory support, and flight safety in navigating congested airspace.

- Air taxi companies must learn the lessons from SATS, a failed government effort in the 2000s to provide on-demand flights to cities not served by major airlines.

At the Paris 2024 Olympics, onlookers will be treated to a new spectacle after the event kicks off this Friday: Air taxis flying within sight of the Eiffel Tower.

German manufacturer Volocopter will be showcasing its electric Vertical Take-Off and Landing (eVTOL) aircraft as France embraces innovation. A landing pad has been set up on a barge off the city’s 13th Arrondissement for the aircraft. Other launch spots are the Charles de Gaulle and Paris-Le Bourget airports and a heliport in Versaille, according to the company.

Volocopter is just one of several air taxi companies aiming to soar high. Globally, commercial air taxi services are expected to start in the next two or three years, with the worldwide market growing to 12,000 aircraft by 2035, according to a new report from consulting firm Bain & Co.

However, eVTOLs are not expected to scale until after the mid-2030s since they initially will remain a service for middle- to upper-income passengers. Key to market growth will be air taxi companies’ ability to absorb initial losses and lower costs over time.

Why air taxis are exciting

Air taxis represent the first new market in civil aeronautics in decades, according to the report, Advanced Air Mobility: What Electric Air Taxis Need to Take Off. This industry includes aircraft manufacturers, suppliers, infrastructure, operators, air traffic management and other services.

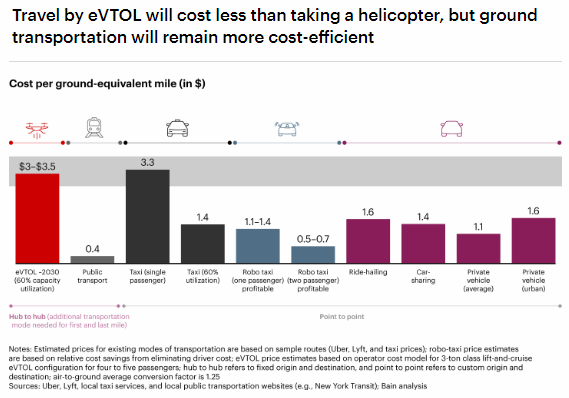

Growth and profitability will not be easy. Relatively higher prices for air taxi services compared to cars and other transportation will limit their use to business travelers and more affluent passengers – although they are cheaper to take than helicopters. Air taxi service could also be used as a cargo service for hard-to-reach areas or when speedy delivery is needed.

“As the market evolves, growth of the customer base will depend on operators offering an acceptable price for faster travel times,” the report’s authors said.

Air taxis also must be integrated into the wider transportation system, so travelers can easily transfer from ground to air and back again without much hassle. Bain & Co. predicts that while air taxis are poised to take off in the mid-2030s, so will competition from autonomous driving vehicles.

“Bain analysis shows the number of eVTOL aircraft will not surpass 15,000 until the mid-2030s, later than many industry experts are forecasting,” the report said.

Factors for a vibrant air taxi market

Battery technology, new air traffic regulations, infrastructure and aircraft certification and performance are factors that would add vibrancy to the air taxi market.

Bain & Co. believes that certification and commercial operations are likely to start in the next two to three years after a few OEMs (original equipment manufacturers) were able to make their aircraft move from vertical to horizontal flight. This was a “key challenge” they overcame, the report said.

Last year, the U.S. Federal Aviation Administration released a detailed plan to support eVTOLs by 2028, with specific steps on how to integrate these aircraft into national airspace. Initially, eVTOL aircraft will have to comply with most existing communication, navigation and surveillance requirements.

Meanwhile, regulators and companies are working to update air traffic management to ensure that eVTOLs can safely operate in congested airspace.

Another factor is the development of landing and take-off “vertiports” in convenient locations for passengers. It will take time and capital for companies to build them, the report said.

Air taxis will have to be part of an end-to-end travel route as well. For example, a flight reservation could include an Uber service that will drop off the passengers at their final destination. Bain & Co. believes that longer air taxi routes will do better than shorter routes, since the latter will face “significant competition” from car services.

Learning from the SATS example

In the 2000s, there was a governmental effort to provide on-demand flights to cities not served by large airlines. The Small Aircraft Transportation System (SATS), a joint effort by the FAA, NASA and local aviation officials, “failed due to insufficient demand, inadequate infrastructure, air traffic congestion, and poor economics,” according to the report. High turbine costs, infrastructure and route limitations, and concerns about safety felled the service.

Air taxi companies must learn from the failure of SATS. That means “above all, they will focus on safety, infrastructure, aircraft performance, and economics,” the authors said.

Safety: Regulators and companies are partnering to ensure that safety standards similar to those of commercial aviation are infused throughout the entire value chain, from components and aircraft safety requirements to air traffic separation rules. The public also must feel safe taking air taxis.

New infrastructure: To grow the market, companies will need to build a network of vertiports with charging stations in populated areas within commuting distance of many people. Operators must offer a “seamless journey, including check-in and security procedures,” the report said.

Aircraft performance: Manufacturers are counting on new architectures and technical solutions to design aircraft that can take off vertically with electric propulsion, which is a key challenge, while meeting payload and range mission requirements. To be successful, aircraft must have a range of at least 70 to 80 miles and accommodate at least three to four passengers.

Economic viability: Bringing down the price of the air taxi service is key, since passengers will be comparing it to other forms of transportation. In most cases, cars and other ground vehicles will still be cheaper. Air taxi operators will need to absorb losses initially, just like Uber did when it started out, but work on making the trips feasible for many passengers over time.

Is the price right?

Three factors go into determining the price for air taxi service: how much the aircraft cost, maintenance expenses, and other operating costs. A four- to five-passenger eVTOL should cost around $3 million to $6 million – excluding multi-rotor aircraft – and last around 10 years. To make money on this investment, the air taxi must be in service for at least 1,000 flight hours a year.

While maintenance of air taxis will be simpler than other aircraft – it doesn’t have a transmission and has impler flight controls – batteries with a limited lifespan are “a significant cost factor.” Operating costs that include pilot salaries, vertiport fees, insurance and energy must be tightly controlled.

“The aerospace industry has begun laying the foundation for a new era of advanced air mobility,” the report’s authors said. “Safety is the critical entry ticket for every competitor. Future winners will forge a business model well adapted to the constraints of the emerging market and will excel at making the new mode of travel convenient and cost-efficient.”