Key takeaways:

- Companies across industries stepped up spending in AI in Q1, according to a report by fintech company Ramp.

- Gains were seen particularly in specialized AI tools, or ‘narrow AI.’

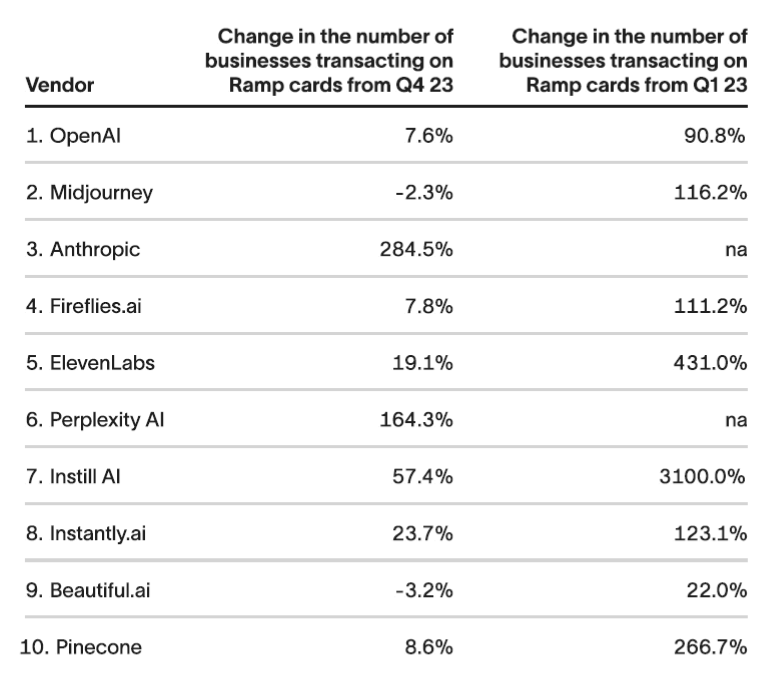

- OpenAI tops the list of AI vendors with the highest number of business clients but on a quarterly basis, Anthropic and Perplexity AI grew faster.

Enterprise spending on AI products and services soared in the first quarter, as the promise of automation, cost savings and improved decision-making encouraged adoption across industries, according to corporate spending data from fintech company Ramp.

AI-related card transactions surged by 293% in the first quarter compared to a year ago, versus an increase of just 6% in overall software transaction volume during the same timeframe. The quarterly Ramp Business Spending Benchmarks aggregates thousands of card and bill pay transactions.

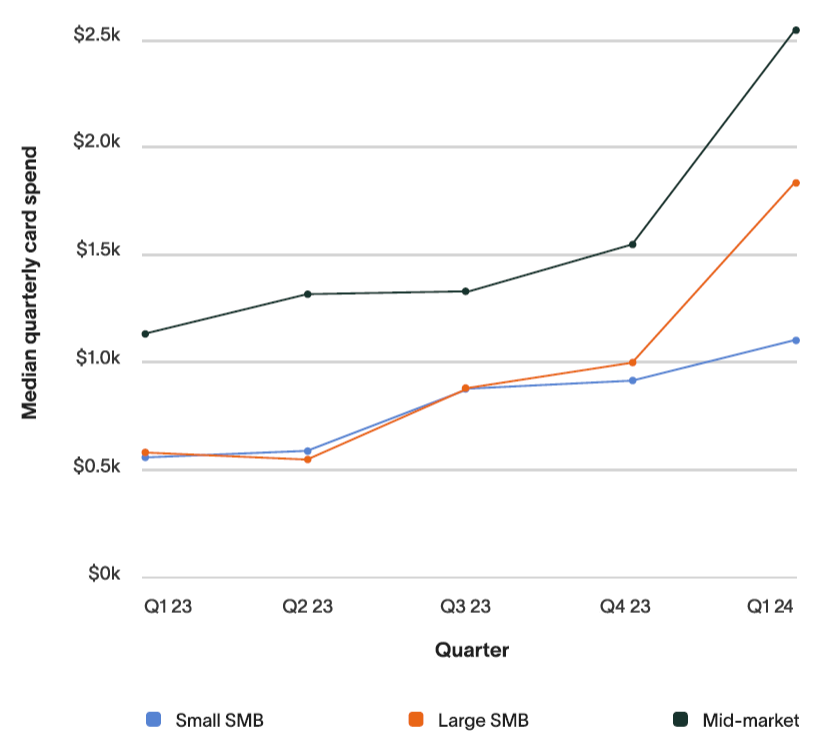

Over a third of Ramp’s customers paid for at least one AI tool, up from 21% of businesses a year earlier. The average company spent $1,500 on AI products and services in Q1, an increase of 138% year-over-year. Notably, non-tech industries are now rapidly embracing AI capabilities.

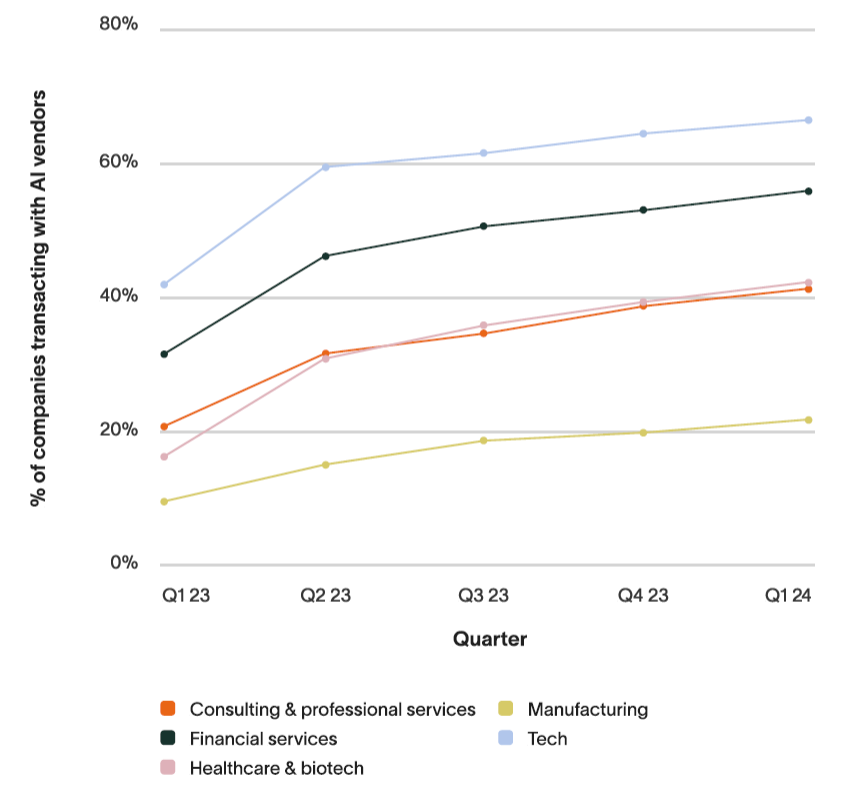

The health care and biotech sector was the fastest to adopt AI tools, seeing a 131% year-over-year jump in the number of firms transacting with AI vendors. “This growth is likely thanks to a proliferation of tools that have begun to demonstrate clear industry-specific use cases — for example, automating radiology workflows to prioritize high-risk cases, double-checking doctors’ conclusions, or scanning and analyzing new research papers for relevant insights,†according to a Ramp blog post.

Financial services firms, meanwhile, grew spending with AI vendors by 331% year-over-year. Manufacturers, tech companies, and consultants also significantly increased their AI transactions in Q1 year-over-year.

In terms of AI vendors with the most number of business clients, OpenAI, the maker of ChatGPT, retains its crown, nearly doubling the number of enterprise customers year-over-year. But quarter over quarter, OpenAI only saw a 7.6% gain. Meanwhile, rival Anthropic (Claude) and Perplexity grew the fastest quarter-over-quarter.

As for AI spending, general AI development tools such as those offered by Databricks and AssemblyAI topped the rankings, but Ramp’s data showed increasing spending on more specialized ‘narrow AI’ products like Seamless.AI, accessiBe, Fireflies.ai and Instantly.ai. Specialty AI companies now comprise four of the top 10 vendors by customer count and expenses.